Gifts of Real Estate

Donate a valuable asset in exchange for powerful tax benefits and possibly an income stream for you and/or your loved ones.

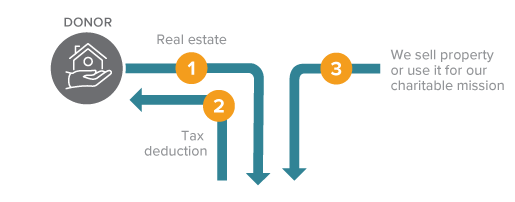

How It Works

- You deed your home, vacation home, undeveloped property, or commercial building to American Rivers.

- American Rivers may use the property or sell it and use the proceeds.

Benefits

- You receive an income tax deduction for the fair market value of the real estate.

- You pay no capital gains tax on the transfer.

- You can direct the proceeds from your gift to support the overall mission of American Rivers.

Next

- You can donate your property yet continue to use it.

- More details about gifts of real estate.

- Frequently asked questions on gifts of real estate.

- Contact us so we can assist you through every step.

Explore More Gift Options

Will or Trust →

You can plan a gift that will not affect your cash flow.

Appreciated Securities →

Take advantage of appreciated securities, avoid tax.

Life Insurance →

Make a significant gift, no matter the size of your estate.

Retirement Plan →

Donate double-taxed assets and leave more to family.

Real Estate →

Donate a valuable asset, receive powerful tax benefits.

Personal Property →

Donate personal property, receive significant tax benefits.

Donor-Advised Fund →

Make a gift from your DAF, or name us a beneficiary.

Contact Us

Planning your estate and legacy for future generations, including your charitable interests, takes careful evaluation. Consulting with the appropriate professionals can assist you.

Contact Us

Eric F Rice, CFP®, CFRE

360-702-3702

plannedgiving@americanrivers.org